Prepare your firm for the Consumer Financial Protection Bureau (CFPB)

The CFPB's subjects are large banks and multi-state lenders. But even if you are a smaller entity, the examiners use the CFPB examination handbook to conduct their audits.

The CFPB's subjects are large banks and multi-state lenders. But even if you are a smaller entity, the examiners use the CFPB examination handbook to conduct their audits.

Your risk of mortgage examination findings by the CFPB can be offset by having written policies and procedures in place for the origination, processing, underwriting, closing and post-closing of mortgage applications. In addition to the rubric of Federal guidelines with which we have become familiar with, the CFPB will extend extra vigilance in the areas of deceptive marketing, riskier product types, underwriting exceptions and Fair Lending. Surprisingly, the guide contains NO reference to information security and ID theft.

Be aware that while the CFPB currently only has a small examination staff, these guidelines are in use by state banking commission examiners. The examination guidelines set forth by the CFPB are no more onerous than those set forth by many states, so compliance managers for non-bank lenders familiar with these types of examinations should feel comfortable with the scope and process. For many lenders, however, the examination may represent a step up in the rigor of the examination process. Expect that, especially at first, examinations will have an element of "hyper-vigilance", with many findings and a substantial time requirement.

Be aware that while the CFPB currently only has a small examination staff, these guidelines are in use by state banking commission examiners. The examination guidelines set forth by the CFPB are no more onerous than those set forth by many states, so compliance managers for non-bank lenders familiar with these types of examinations should feel comfortable with the scope and process. For many lenders, however, the examination may represent a step up in the rigor of the examination process. Expect that, especially at first, examinations will have an element of "hyper-vigilance", with many findings and a substantial time requirement.

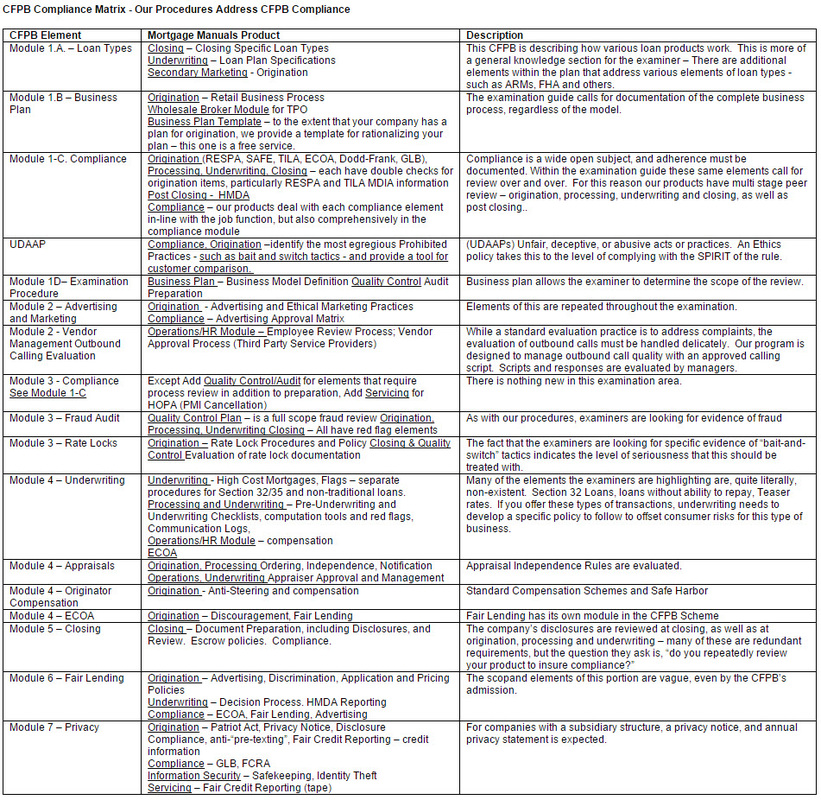

CFPB Mortgage Compliance Matrix

We have examined the CFPB's requirements for compliance by going through each section of the CFPB examination/audit handbook for examiners. All of the requirements of the CFPB are aligned with the section/product module in our packages.