Information Security/FACTA Red Flag/GLB Privacy & Safeguards Policy and Procedure Model Plan

Includes Disaster Recovery, Cybersecurity, Business Continuity and Risk Assessment

Compliance with 16 CFR section 314.4 - Safeguarding rules extended

The FTC enhanced rules surrounding Gramm-Leach-Bliley Safeguarding and entered them into the Federal Register Dec. 9, 2021, to go into effect December, 2022. We updated our model policies at that time. The agency gave another extension, until June, 2023, for the rules to go into effect, to allow industry to more time to prepare.

States With Significant GLB Examinations

We have encountered significant examination requirements in New York, Massachusetts, Maryland, Virginia, Texas, Michigan. We have developed a rubric and draw a straight line to the GLB requirements within our model plan.

NYS Department of Banking raises the bar on Cybersecurity - Our Product Meets the Requirements

Fannie Mae Requires NPI Policy - Not just what is required to be protected, but also how you will secure hardware

Information Security/Cybersecurity is Industry Hot Button

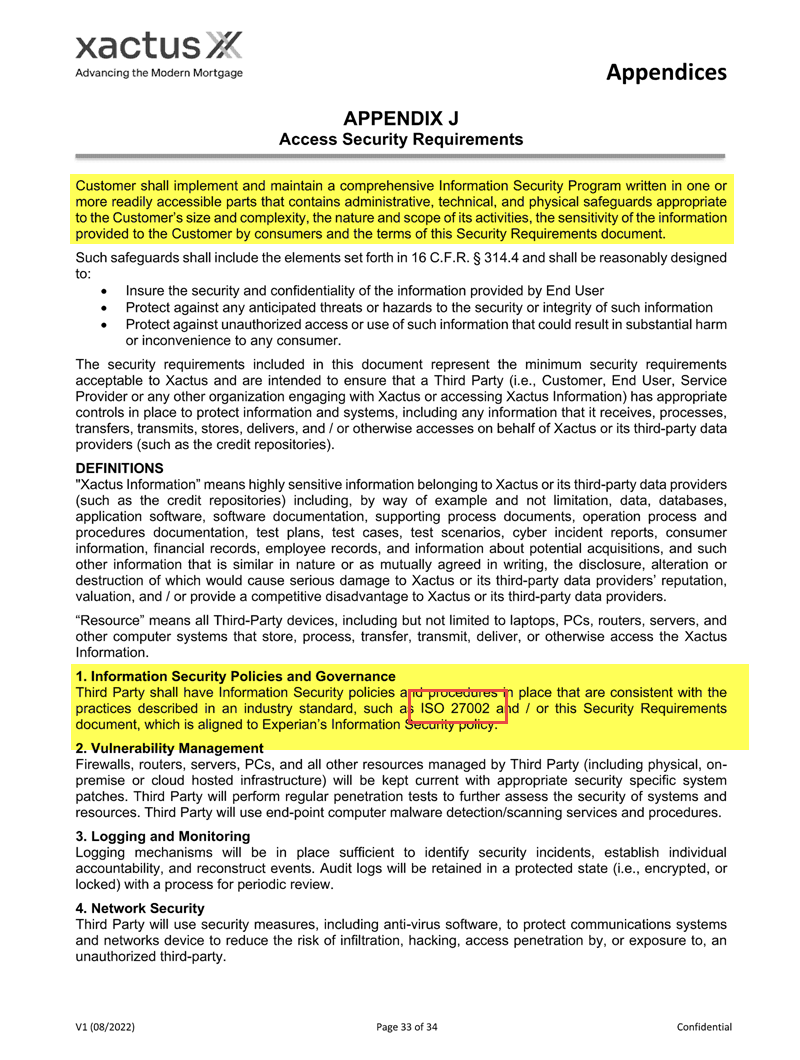

The FTC requires that all companies which handle sensitive consumer information implement a Red Flag ID Theft detection plan. We provide the Red Flag Plan, but also provide an information security plan and an employee training plan to make complying with the law simple. A company can't have a Red Flag rule if it doesn't already have an information security plan. We have combined information security, mortgage origination, processing and closing with this Red Flag program to provide a comprehensive program that can actually be put into use.

This is the ONLY information security/cybersecurity NPI and ID Theft Red Flags Plan available that is written specifically for the mortgage industry.

The Gramm-Leach-Bliley Act requires that all companies handling private consumer information have a Red Flag ID Theft detection plan in place. We provide the Red Flag Plan, but also provide an information security plan and an employee training plan to make complying with the law simple. Many states also require proof that lenders have an information security plan in place. If you are using a credit bureau to obtain consumer reports, you must also have an information security program under Fair Credit Reporting Act (FCRA) Requirements.

The FTC enhanced rules surrounding Gramm-Leach-Bliley Safeguarding and entered them into the Federal Register Dec. 9, 2021, to go into effect December, 2022. We updated our model policies at that time. The agency gave another extension, until June, 2023, for the rules to go into effect, to allow industry to more time to prepare.

States With Significant GLB Examinations

We have encountered significant examination requirements in New York, Massachusetts, Maryland, Virginia, Texas, Michigan. We have developed a rubric and draw a straight line to the GLB requirements within our model plan.

NYS Department of Banking raises the bar on Cybersecurity - Our Product Meets the Requirements

Fannie Mae Requires NPI Policy - Not just what is required to be protected, but also how you will secure hardware

Information Security/Cybersecurity is Industry Hot Button

The FTC requires that all companies which handle sensitive consumer information implement a Red Flag ID Theft detection plan. We provide the Red Flag Plan, but also provide an information security plan and an employee training plan to make complying with the law simple. A company can't have a Red Flag rule if it doesn't already have an information security plan. We have combined information security, mortgage origination, processing and closing with this Red Flag program to provide a comprehensive program that can actually be put into use.

This is the ONLY information security/cybersecurity NPI and ID Theft Red Flags Plan available that is written specifically for the mortgage industry.

The Gramm-Leach-Bliley Act requires that all companies handling private consumer information have a Red Flag ID Theft detection plan in place. We provide the Red Flag Plan, but also provide an information security plan and an employee training plan to make complying with the law simple. Many states also require proof that lenders have an information security plan in place. If you are using a credit bureau to obtain consumer reports, you must also have an information security program under Fair Credit Reporting Act (FCRA) Requirements.

What is included

Procedures Specific to the Mortgage Industry

FACTA Required Red Flags Plan

FCRA and GLB Required Safeguarding Plan

Risk Assessment

Employee Training Program Included

Working with Vendors (Risk Assessment)

Clean Desk Policy

Document Retention/Destruction

Safeguarding Private (non-public) NPI Data (GLB)

Red Flags in Origination

Remote Work Policy

Working with Borrowers

Breach/Incident Remediation and Reporting

Disaster Recovery/Business Continuity

Risk Assessments

Red Flags in Processing

Closing/Funding Red Flags

Servicing Red Flags

FACTA Required Red Flags Plan

FCRA and GLB Required Safeguarding Plan

Risk Assessment

Employee Training Program Included

Working with Vendors (Risk Assessment)

Clean Desk Policy

Document Retention/Destruction

Safeguarding Private (non-public) NPI Data (GLB)

Red Flags in Origination

Remote Work Policy

Working with Borrowers

Breach/Incident Remediation and Reporting

Disaster Recovery/Business Continuity

Risk Assessments

Red Flags in Processing

Closing/Funding Red Flags

Servicing Red Flags

Sample Table of Contents |

| ||||||

Video edited on Kapwing

Purchase Information Security, FACTA Red Flag and ID Theft Plan

|

Price $395

|

Information Security Module is part of the Complete Banker or Correspondent Packs and Compliance Packs

Referred by a consultant, association, or wholesaler? Click here to request a discount code! Download is delivered by e-mail link - allow 5-15 minutes for delivery |