New York State Mortgage Lender or Broker Licensing Application or Examination Support

New York State Examinations can be very intimidating, especially for smaller companies: all are expected to have a complete set of operating procedures and policies. Furthermore, New York State Department of Financial Services (NYDFS) considers itself a leader in financial regulation, and in the area of Cybersecurity they have taken a lead role.

In 2015, New York State Banking Department issued a set of very helpful guides for mortgage industry participants. For Mortgage Bankers However, they do not necessarily request copies of the material referenced in the guide, and the material in the guides is not the only material they request.

While a complete set of operating policies may seem like overkill for the small mortgage broker, there are a minimum set of procedures that you will want to have in place. We have packaged them especially for the small broker right here.

In 2015, New York State Banking Department issued a set of very helpful guides for mortgage industry participants. For Mortgage Bankers However, they do not necessarily request copies of the material referenced in the guide, and the material in the guides is not the only material they request.

While a complete set of operating policies may seem like overkill for the small mortgage broker, there are a minimum set of procedures that you will want to have in place. We have packaged them especially for the small broker right here.

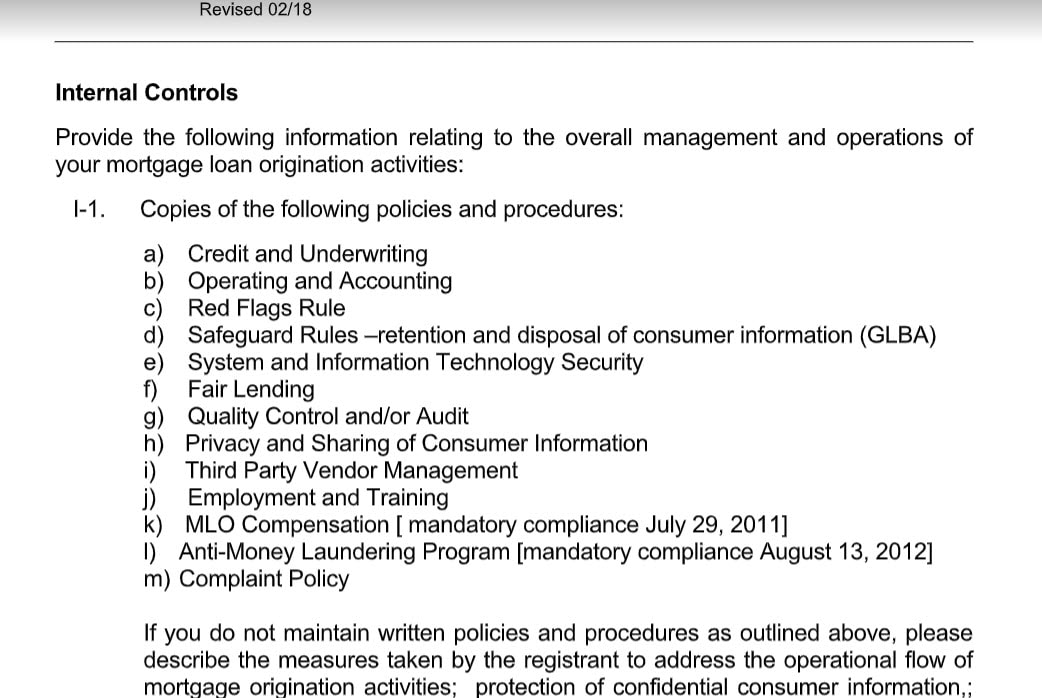

Policies and Procedures

|

order to help facilitate the broker's examination process, we will assemble all of the required policies and procedures, in the order and format that the state requests, and provide you with a "ready to submit" package of information for your regulator.

Obviously, you will still have to assemble all of the material relative the examination of your loan files and physical operation. Purchase the Compliance Pack for a "Do-it-yourself" solution. |

NY DFS Specific Requirements

While all states generally require compliance with federal laws, New York has elevated its enforcement in a number of areas:

- Fair Lending Plan - New York State has its own additions to Fair Lending Plans, so we create a separate one meeting the Executive Letter requirements - This is included by request in our standard policies and procedures.

- Compliance Plan - Different from a "Compliance Policy", New York State's regulatory compliance plan requires training, audits, assessments and compliance oversight of all the listed regulations. This includes a risk assessment. While certain elements are automatically mitigated by adhering to your policies and procedures, be advised that New York expects that you will audit higher risk elements monthly or quarterly. These cannot be templated and should very closely reflect your business. This is included by request in our standard policies and procedures. (7) New York, New York - If you can GET approved there... | LinkedIn

- Cyber-Security - Though some small companies may be exempt from some elements, New York requires ALL companies to have a robust cybersecurity plan. If you own any of your infrastructure, that infrastructure must be tested. If you do not own the infrastructure, you must vet your vendors to ensure they have testing and compliance plans. We have an article here: Mortgage News Digest: New York State "Cybersecurity" Requirements

- AML Audits - New York is one of a growing number of states that require documentation of the independence of your internal audit. If you cannot document this - and they are really forcing this - you must use a 3rd party. We have that audit service as an add-on here

Licensing or Audit Package

Responding to an Examination Notice

If you have received an examination notice, the best way to analyze the requirements is to parse, line by line, the requirements as outlined on the NMLS Company Licensing Checklist, or in the examination letter notice and document request. The single most important element in this process; the company must correctly identify the document and relate it to the explicit request. For example, if the regulator requests a business plan, you must follow their taxonomy to the letter; This document should be named [Company Legal Name] RM Business Plan.

If you have received an examination notice, the best way to analyze the requirements is to parse, line by line, the requirements as outlined on the NMLS Company Licensing Checklist, or in the examination letter notice and document request. The single most important element in this process; the company must correctly identify the document and relate it to the explicit request. For example, if the regulator requests a business plan, you must follow their taxonomy to the letter; This document should be named [Company Legal Name] RM Business Plan.

Best Options for Audit/License Preparation - State of New York

|

Full Service option - purchase the Audit Preparation Service below, which will include extracting and stacking the documents.

|

Do it yourself option - Purchase the New York Broker Compliance Package or Lender Compliance Package, depending on your model.

|