North Carolina Mortgage Lender or Broker Licensing Application or Examination Support

Long a leader in regulatory enforcement (the first state to require Loan Originator licensing, pre-licensing education, predatory lending rules), North Carolina's licensing application and periodic examination procedures have been augmented and expanded. As a model, we agree with the depth of the review, mostly because of the transparency with which they approach the review. All of the materials needed in loan files is clearly stated in the checklist (which looks a little like the one we have been publishing since the 90's!). Our article here shows lessons we have learned in meeting their specific review requirements.

Responding to an Examination Notice

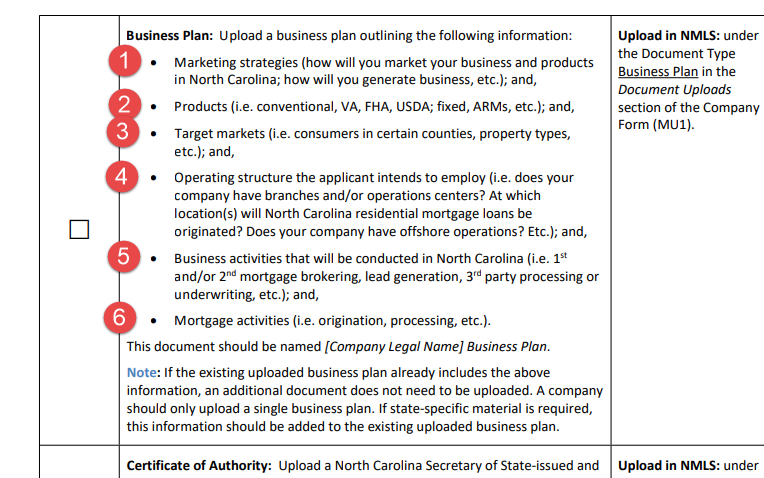

If you have received an examination notice, the best way to analyze the requirements is to parse, line by line, the requirements as outlined on the NMLS Company Licensing Checklist. The single most important element in this process; the company must correctly identify the document and relate it to the explicit request. For example, if the regulator requests a business plan, you must follow their taxonomy to the letter; This document should be named [Company Legal Name] RM Business Plan.

Responding to an Examination Notice

If you have received an examination notice, the best way to analyze the requirements is to parse, line by line, the requirements as outlined on the NMLS Company Licensing Checklist. The single most important element in this process; the company must correctly identify the document and relate it to the explicit request. For example, if the regulator requests a business plan, you must follow their taxonomy to the letter; This document should be named [Company Legal Name] RM Business Plan.

North Carolina Business Plan Requirement

|

When the request asks for a business plan, often our customers confuse this with an actual "SBA Style" business plan, laying out the ways and means of a business, such as this one. However this is NOT what they want. Instead, answer the questions on a single document that identifies the answers.

Here is an article on this matter |

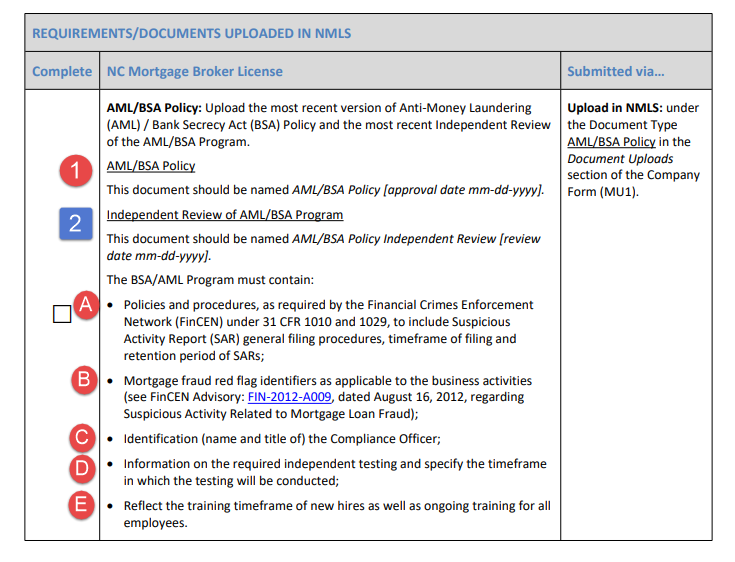

North Carolina Anti-Money Laundering Plan

Again, you must parse the requirements. In THIS case, there are actually TWO documents requested;

We also provide the training you need, and a tool to decide whether LO's who have take NMLS continuing education have received enough training within that to avoid duplicative training.

- an AML/BSA Plan (1) ,

- an AML/BSA Review (2) or Audit.

We also provide the training you need, and a tool to decide whether LO's who have take NMLS continuing education have received enough training within that to avoid duplicative training.

North Carolina Periodic Examination Preparation

The examination focuses on your compliance with your own policies and procedures.

- A detailed loan checklist like the one in our Quality Control Plans will help you ensure your loans are complete without having to go back through a year or two of production to review.

- You should ensure you have all of your physical locations reviewed to meet state requirements.

- Ensure you aren't paying anyone as a contractor who should be licensed.

- Ensure you have copies of all your employee training records (not just NMLS certificates, but syllabi and attendee records for non-NMLS training). If you are missing compliance training you can find it here.

- Ensure you have your IT/Cyber-Security plan in place.

Best Options for Compliance

|

Do it yourself option - Purchase the Broker Compliance Package or Lender Compliance Package, depending on your model.

|

Full Service option - purchase the Audit Preparation Service, which will include extracting and stacking the documents.

|